Tax Data Indicate Strong Retail Sales Growth in Central Virginia

Two days prior to the Charlottesville Regional Chamber of Commerce’s inaugural Eggs & Issues Legislative Breakfast on September 27, the Chamber today released its mid-year analysis of retail sales tax revenue, showing strong retail growth in the region.

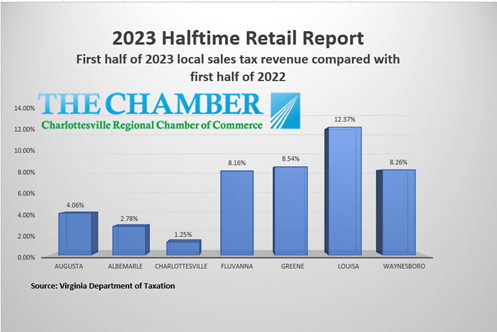

Tax data indicate 2023 retail (and internet) sales growth in all seven Central Virginia localities tracked by the Charlottesville Regional Chamber of Commerce.

In total, the localities studied collected nearly $1.5 million (4.60%) more in retail sales tax in the first half of 2023 compared to the first half of 2022. Louisa County saw the largest percentage increase (12.37%) while Fluvanna, Greene, and Waynesboro all exceeded 8% growth over 2022. The slowest growth localities were Augusta (4.06%), Albemarle (2.78%), and Charlottesville (1.25%).

Chamber CEO Natalie Masri said, “While the retail sector continues to expand regionally, our analysis indicates our retail core – Charlottesville and Albemarle County – is not keeping up with the pace of inflation.”

Masri said the Eggs & Issues Legislative Breakfast will include informed outlooks for our economy and the upcoming elections. Speakers include DecideSmart’s Dr. Bob Holsworth, Virginia’s Deputy Secretary of Labor Anthony Reedy, and the U.S. Chamber of Commerce’s Clark Jackson.

Limited tickets are still available – click here to register.

The 2023 analysis is based on the Virginia Department of Taxation’s Local Option Sales Tax Data. According to the Center for Economic Policy Studies at the University of Virginia Weldon Cooper Center for Public Service:

“Any city and county may levy a general retail sales tax at the rate of one percent to provide revenue for the locality’s general fund. All local sales tax moneys collected by the localities are paid into a state treasury special fund. The State collects and distributes this Local Option one percent Sales and Use Tax, as provided under the Code of Virginia §58.1-605 and §58.1-606. Actual distributions are made monthly to every county and city based on the locality in which the tax was collected. The amounts are recorded in the Local Option Sales Tax report.”

In general, all sales, leases, and rentals of tangible personal property in or for use in Virginia, as well as accommodations and certain taxable services, are subject to Virginia sales and use tax, unless an exemption or exception is established. Fuel and automobile sales are not included in the local sales tax option. The local “option” is a bit of a misnomer as the State has mandated its collection at a minimum of 1% for all localities in the state (Hampton Roads, Northern Virginia, and Historic Triangle have additional sales tax).